Exploring the World of Online Forex Trading Platforms

In recent years, online forex trading platforms have transformed the way individuals invest in the foreign exchange market. With their accessibility and user-friendly interfaces, these platforms allow traders from all over the world to engage in currency trading with ease. Among the top options available is online forex trading platform Turkiye Brokers, known for its competitive features and excellent customer service. In this article, we will dive deep into what makes a forex trading platform effective and how to select the best one for your trading needs.

The Importance of Choosing the Right Forex Trading Platform

Forex trading platforms act as the gateway for traders to access the foreign exchange market. Therefore, the choice of an online forex trading platform significantly influences trading success. A reliable platform can enhance a trader’s experience by providing them with the tools and resources needed to make informed trading decisions.

Key Features to Look For

When evaluating online forex trading platforms, it’s crucial to consider several key features:

- User Interface: A simple, intuitive user interface can make the trading experience smoother, especially for beginners.

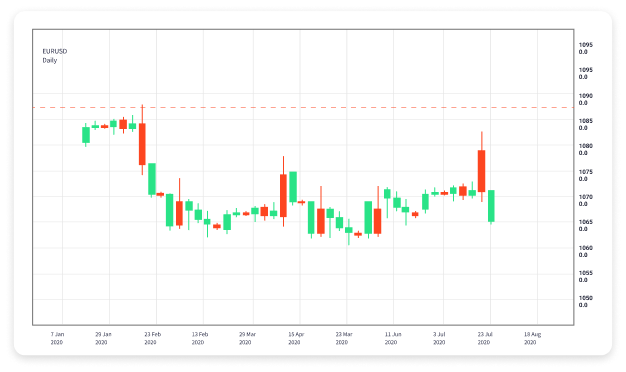

- Trading Tools: Look for platforms that offer a variety of trading tools, including charting tools, technical indicators, and risk management features.

- Mobile Compatibility: Many traders value mobility and the ability to trade on-the-go through mobile applications.

- Security Measures: A robust security framework that protects personal and financial information is vital.

- Customer Support: Efficient customer support that is readily available can assist traders when issues arise.

Types of Trading Orders

Another important aspect of forex trading platforms is the types of trading orders they support. Understanding different order types can significantly impact a trader’s effectiveness:

- Market Order: An order to buy or sell a currency pair at the current market price.

- Limit Order: An order to buy or sell a currency pair at a specified price or better.

- Stop-Loss Order: An order placed to limit losses on a position by closing it when the price reaches a certain level.

- Take Profit Order: An order that automatically closes a position once a specified profit level is achieved.

Evaluating Broker Regulations

Regulation is another crucial aspect when selecting an online forex trading platform. Reputable brokers are typically regulated by financial authorities which ensures they adhere to strict standards of conduct and transparency. Before opening an account, check if the broker is regulated by recognized bodies such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US.

Costs and Fees

Costs associated with trading can eat into profits, which is why it’s essential to consider the fee structure of the platform. Common fees to look out for include:

- Spreads: The difference between the buying and selling price, which is often how brokers make money.

- Commissions: Some brokers charge a commission on each trade, while others may operate on a spread-only model.

- Withdrawal Fees: Fees that may apply when withdrawing funds from your trading account.

Demo Accounts: A Learning Tool

Many forex trading platforms offer demo accounts where users can practice trading without any financial risk. This feature is particularly beneficial for beginners who want to familiarize themselves with the trading environment and platform functionalities before committing real money. A demo account helps in honing trading strategies and understanding market dynamics.

Choosing the Right Trading Platform Based on Trading Style

Another important consideration is the trader’s style. Day traders may prefer high-speed platforms with advanced analytical tools, while long-term investors may benefit more from platforms that allow easier management of multiple positions over time. Understanding your trading style can significantly improve your trading experience and outcomes.

Conclusion: Take Your Time

Selecting the right online forex trading platform takes time and careful consideration. It’s crucial to thoroughly research and review different platforms before making a decision. Look for features that align with your trading goals and style, and don’t hesitate to test platforms using demo accounts. The world of forex trading is full of opportunities, and with the right platform at your side, you can maximize your potential in this dynamic financial market.